You’ve just discovered a fantastic new place at the right location and are ready to make a purchase.

The only thing is, your present home may be too good an investment to sell. Or, the market prices may be falling, and you may not be getting worthwhile offers. Getting let-to-buy mortgages might be the perfect solution in such a situation.

If you’re confused about what let to buy mortgages are, this guide is just for you. It explains all about such mortgages in detail, as well as their best alternatives, so keep reading.

Table of Contents

- What Is A Let-To-Buy Mortgage?

- Who Should Consider A Let-To-Buy Mortgage?

- 1. You Want To Move Into Your New Home Quickly

- 2. Selling Your Old House May Be Difficult

- 3. Purchasing A New Property With A Partner While Retaining Ownership Of Your Existing Property

- 4. The Existing Property Is A Good Investment For The Future

- 5. You May Be Planning To Move Back Into Your Old Home In The Future

- How Do Let To Buy Mortgages Work?

- Eligibility Criteria For A Let To Buy Mortgages

- Getting A Let-To-Buy Mortgage

- How Much Can You Borrow?

- Let-To-Buy Vs Buy-To-Let

- Let-To-Buy Alternatives

- Conclusion

- Frequently Asked Questions

What Is A Let-To-Buy Mortgage?

A let-to-buy mortgage is designed for people looking to purchase a new home but who may be unable or unwilling to sell their existing one. It allows letting out your home and remortgaging it into a buy-to-let mortgage, which makes it available on the rental market.

This enables you to get rental income just like standard buy-to-let properties, which can be used to repay the mortgage on the house.

Doing so allows you to get another mortgage for purchasing a new house if the repayments for both mortgages are sustainable and affordable.

In most cases, the equity of the original home can be used to borrow your deposit for the new mortgage.

Sometimes, lenders may provide a comprehensive let-to-buy service and can make arrangements for both mortgages, but it may be better to get the mortgages from different lenders.

Let-to-buy is a popular choice with couples having separate properties but wanting to move in together. In such instances, they can move into one of the properties and rent out the other through a let-to-buy mortgage.

Thus, there will be two active mortgages simultaneously, one a regular mortgage and the other a let-to-buy one.

Who Should Consider A Let-To-Buy Mortgage?

A let-to-buy mortgage is most beneficial for people wanting to use the equity built up in their existing homes to purchase a new one while retaining their present home.

However, there are some other situations where this type of mortgage can come in handy.

1. You Want To Move Into Your New Home Quickly

Sometimes, you may be willing to sell your current home and move into a new one quickly. However, selling a house requires considerable time and effort, and it may be a long while before the house gets sold.

Getting a let-to-buy mortgage on the property might be the best solution in such cases. You can use the rental income as a deposit on the mortgage for the new house and move into it without waiting for the old house to get sold.

2. Selling Your Old House May Be Difficult

Market fluctuations are a major factor that can prevent you from selling an existing property. People tend to avoid selling their properties when prices are falling and may need to wait for the prices to start rising again.

In this instance, a let-to-buy mortgage can help you use the existing property to get another mortgage and buy a new home.

3. Purchasing A New Property With A Partner While Retaining Ownership Of Your Existing Property

A let-to-buy mortgage is ideal for those planning to buy a new home with a partner without selling off their existing home.

You can retain complete control over your current home while the new property will have joint ownership.

4. The Existing Property Is A Good Investment For The Future

At times, the original property might seem an excellent investment for the future, and you may not want to sell it.

If that’s the case, getting a let-to-buy mortgage can help you retain ownership of the existing house even if it is not going to be used for living purposes presently.

5. You May Be Planning To Move Back Into Your Old Home In The Future

It may happen that you may have to relocate somewhere else for various reasons, but you plan on moving back into the present home in the future.

In such situations, selling the existing property is not a great idea, and a let-to-buy mortgage can help avoid that while making it possible to earn rental income.

How Do Let To Buy Mortgages Work?

Since a let-to-buy mortgage involves two mortgages, there are several factors to consider.

You need to meet the eligibility requirements for both mortgages and should be able to make repayments timely.

For that, the lender needs to know that there is enough equity in your existing property to serve as a deposit on the remortgage. At the same time, the equity should be able to fund a deposit for the new mortgage.

Eligibility Criteria For A Let To Buy Mortgages

All let-to-buy lenders have certain criteria that you need to meet before being eligible for a let-to-buy mortgage. These generally include the following:

1. Equity

In most cases, lenders will require atleast 25% equity in the property to consider a let-to-buy mortgage. However, lenders can set the minimum equity requirement as high as 40%.

Additionally, the LTV is affected by the property cost, and in some cases, lenders may be willing to reduce it if the property value is high.

2. Age

Most lenders only offer a let-to-buy mortgage to people between the ages of 25 and 75, though in some instances, the maximum age may be lower.

3. Income

The minimum personal income requirement is more important when getting a let-to-buy mortgage than a buy-to-let option and can range from £15,000 to £25,000.

Moreover, the rental income should be able to cover between 125% and 145% of the mortgage repayments.

4. Evidence Of Rental Arrangements

Lenders generally require proof that your existing property will be rented out and not sold.

5. Proof Of Onward Purchase

You will also need to provide the lender evidence that you’re purchasing a residential property, which can be provided through a copy of the mortgage offer for the home.

Getting A Let-To-Buy Mortgage

These are the steps you need to follow to get a let-to-buy mortgage. It is highly recommended to take the help of a mortgage broker when completing them, as it can make things a lot easier.

1. Determine The Property Value

Since a let-to-buy mortgage requires remortgaging the property into a buy-to-let option, determining the property value is the first thing to do. You can do so using property value websites or with an estate agent’s help.

2. Find Out The Rental Value

Before providing a mortgage, the lender will want to be sure that the rent from the property can cover the repayments. Generally, this rental coverage is around 125% of the payable interest.

This means that the existing property should provide enough rent to meet this requirement, and it has to be verified by a letting agent.

3. Fill Out Mortgage Applications

You will need to apply for both mortgages and in both cases, the applications will involve checks to ensure you meet the eligibility requirements.

Keep in mind that the requirements for a remortgage will be slightly different from those for a fresh mortgage for the new property.

4. Time The Applications Correctly

It is extremely unlikely that both mortgage applications will get approved at the same time.

But it is not possible to complete a mortgage for the new property without completing the remortgage for the old one. So, make sure to submit both applications at the same time.

5. Consider The Tax

Disclaimer: When it comes to taxes, this is just general advice and not to be relied upon as fact. When it comes to tax everyone’s position and circumstances are different and the rules are changing all the time. Only by seeking advice of a qualified tax professional can you be certain you are complying with all the relevant tax rules & regulations.

If you get a new home, the original one that will not be used for residential purposes will become a second property. This means you will need to pay a 3% stamp duty on purchasing the new house.

However, this amount can be recovered in the form of a refund if the property is sold within 36 months.

How Much Can You Borrow?

Most lenders offering let-to-buy mortgages provide 75% LTV, which means that you need to deposit at least 25% of the value of your existing property.

When a borrower has a lot of equity, at least a part of this amount can be used as a deposit for the new house.

Also, in a few cases, lenders may offer a higher LTV if you find it difficult to deposit 25% of the property value.

Apart from that, as mentioned before, the rental income from the original property should cover 125% of the monthly mortgage payments.

A local letting agent can help determine how much rent you can charge for the property by providing a rental valuation. This can also serve as evidence for the lender in case they have doubts regarding the rent-earning potential of the property.

Finally, for your new home, having a deposit of at least 10% of the property value is a good idea. That being said, being able to provide a larger deposit will attract better rates from lenders.

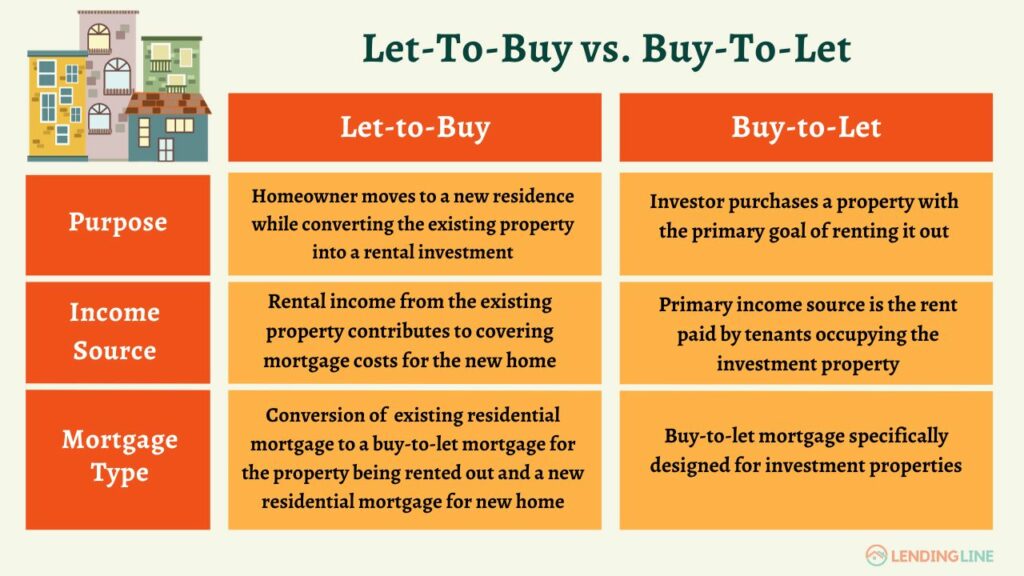

Let-To-Buy Vs Buy-To-Let

While a let-to-buy mortgage may sound similar to a buy-to-let one, both are completely different options.

A let-to-buy mortgage allows borrowers to retain ownership of their original house while purchasing a new one. In contrast, a buy-to-let mortgage allows them to invest in a property that will be rented out for a rental income.

The former option is ideal when you do not wish to sell the existing property, while the latter provides an easy entry into the rental market. In this case, you may not own any property and will first need to invest in one that can be let out.

This is the most important difference between the two, as in a let-to-buy option, having an existing home is a crucial factor.

Let-To-Buy Alternatives

In case you’re not sure about getting a let-to-buy mortgage, there are a few alternatives you can consider.

1. Buy-To-Let Mortgages

If you have no plans of getting a new home but want to gain some experience of the rental market, a buy-to-let mortgage might be a better choice. It is also ideal for people who want to rent additional property instead of purchasing it.

2. Second-Charge Mortgages

A second-charge mortgage also allows utilising equity from your existing home without getting a remortgage.

Under this, it is possible to mortgage your existing property for a loan which can be used as a deposit for buying a new one.

Second-charge mortgages can be more affordable than let-to-buy ones if the lender provides early repayment charges.

3. Consent To Let

Most residential mortgages prohibit you from renting out your property, although it may be possible in some cases. This requires obtaining permission from the lender and is known as consent to let.

Lenders can refuse permission, but if they allow letting out the property, the residential mortgage will continue but you will have permission from your existing lender for a set period of time that you can rent the property out to tenants.

4. Renting

You may have found a good place to move to, in which case, taking it on rent and selling the existing property might be a viable option. While it may mean you have to sell at a lower price, it can help save a lot on stamp duty.

Conclusion

A let-to-buy mortgage provides an excellent solution for people wanting to move into a new home without letting go of the old one.

By allowing you to earn rental income through the existing property, it helps make financial arrangements for purchasing the new one.

On the flip side, it results in two mortgages that can lead to an increase in monthly expenditure. Furthermore, you will need to pay stamp duty after becoming the owner of a second home.

Because of these reasons, it may not be the best option for everyone, and alternatives such as renting or second-charge mortgages might be more suitable.

Speak to a mortgage broker to help you compare the advantages and downsides of the various options to select the most suitable one for your circumstances.

Frequently Asked Questions

1. Is there a stamp duty on let to buy mortgage?

Yes, there is a stamp duty on let to buy mortgages in the UK. The additional stamp duty starts from 3% and can go up to 15% based on the value of the property you are purchasing. If you sell your previous main residence within 3 years of buying your new one, you may be eligible for a refund of the extra stamp duty you paid.

2. How much deposit do you need for a let to buy mortgage?

For a Let to Buy mortgage in the UK, you typically need a deposit of at least 25% of the property’s value. However, this can vary depending on the lender and your financial circumstances.

3. What is the difference between Consent to let vs Let to Buy?

“Consent to Let” refers to getting permission from your current mortgage lender to rent out your property, usually for a short period. “Let to Buy”, on the other hand, involves moving out of your current home, renting it out, and taking out a new mortgage to buy a new home to live in.

**A buy to let mortgage will be secured against your property.

Some types of buy to let mortgages are not regulated by the Financial Conduct Authority.

All content is written by qualified mortgage advisors to provide current, reliable and accurate mortgage information. The information on this website is not specific for each individual reader and therefore does not constitute financial advice.

I am CeMAP & CERER qualified mortgage adviser and have helped a number of clients realise their dreams when they thought it would not be possible. I’m skilled at getting mortgages sorted for people with a history of missed payments, CCJs, defaults, debt management programmes, IVAs and bankruptcies.

I am CeMAP (Certificate in Mortgage Advice and Practice) qualified mortgage adviser with a strong background in Finance. I specialise in providing expert advice on a range of mortgage products, including first-time buyers, remortgages, buy-to-let mortgages and bad credit mortgages.