Who doesn’t want to own a house? In fact, it’s a lifelong dream for many individuals.

And for most of them, securing a mortgage is a crucial step towards realising this dream. However, life can be unpredictable, and financial hardships can arise, leading to missed payments and defaults on your credit commitments.

While defaulting on your credit commitments can be a distressing experience, it does not necessarily mean you cannot own your dream house.

Hence, we will discuss how to obtain a mortgage with defaults and shed light on the implications, challenges, and potential solutions for borrowers facing such situations.

We will also explore the causes behind mortgage defaults, the consequences they entail, and the impact they can have on an individual’s creditworthiness.

All this so you can reclaim financial stability and fulfil your life goals!

Table of Contents

- What Is A Default?

- Can You Get A Mortgage With A Default?

- Honesty Is The Best Policy

- Does The Type Of Default You Have Matter For A Mortgage?

- How To Get A Mortgage With Defaults?

- Eligibility Criteria For Getting A Mortgage With Default

- How Your Income Can Affect Your Mortgage Approval

- Frequently Asked Questions

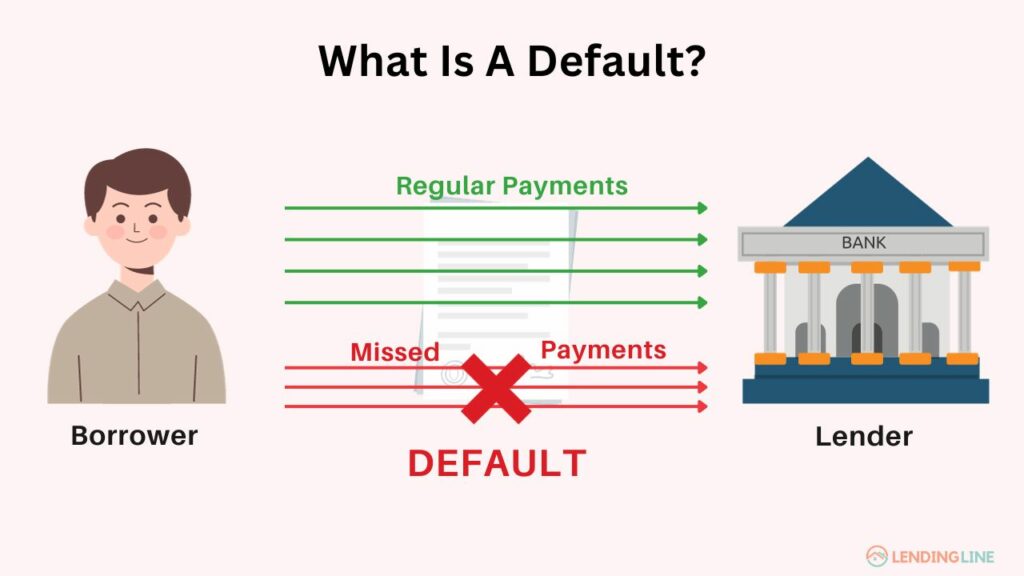

What Is A Default?

Defaulting on a credit agreement is when a borrower fails to meet the repayment obligations, leading the creditor to register missed payments to credit reference agencies. This typically happens when the borrower misses several consecutive payments.

It’s important to note that defaults can occur with various types of credit agreements, such as personal loans, car finance agreements, credit cards, mortgages, etc.

Regardless of whether the debt is paid off or not, the default will be recorded on the borrower’s credit report for a period of six years.

During this time, lenders and financial institutions can see the default when assessing the borrower’s creditworthiness.

It serves as a negative mark on the credit history, potentially impacting future borrowing opportunities.

Understanding the implications of defaults on credit agreements is crucial for individuals seeking to manage their finances responsibly and protect their credit profiles.

Can You Get A Mortgage With A Default?

First off, you must understand that the lending criteria of every lender is different. Some focus on providing competitive rates to customers with excellent credit histories, while others specialise in lending to self-employed individuals or those with a history of bad credit.

Fortunately, numerous mortgage lenders are willing to consider applicants with defaulted credit accounts on their records.

Contacting a mortgage broker can help accelerate the process of finding a suitable lender, saving you the time and effort of comparing rates on your own.

A mortgage broker possesses the knowledge of lenders that offer more favourable rates and terms for borrowers with different circumstances. They can provide valuable guidance on areas where you can potentially save money throughout the mortgage application process.

As such, you can gain access to their expertise and networks, increasing your chances of finding a lender who understands your situation and offers suitable terms.

So, collaborating with professionals in the mortgage industry can help secure a mortgage even with a history of defaulted credit accounts.

Honesty Is The Best Policy

To increase your chances of a successful mortgage application, being upfront and honest with your mortgage advisor about your credit history is important.

Confidentiality is ensured, but providing inaccurate information can lead to delays and missed opportunities.

By sharing your circumstances, a mortgage broker can find the most suitable lender for you, saving time and improving your chances of securing a favourable rate.

Does The Type Of Default You Have Matter For A Mortgage?

Lenders view secured loans or mortgage payment defaults as significant and consider them carefully during their decision-making process.

But there are lenders who are more lenient when it comes to missed payments on mail-order accounts or mobile phone contracts.

The nature of your default can significantly impact your mortgage application. Not all defaults are treated equally, as certain lenders may be more inclined to consider specific types of defaults over others.

For instance, a default on a secured loan can be seen as more severe than one on a phone bill. Some lenders acknowledge this distinction and evaluate applications accordingly.

On the other hand, some lenders may view all defaults as equal and may decline to offer a loan altogether.

There are numerous lenders who can consider mortgage applications for individuals with defaults, regardless of whether they were related to a secured loan or a phone bill.

The key lies in finding the right lender who is well-suited to your specific circumstances. So, seeking appropriate advice before approaching a lender is crucial.

How To Get A Mortgage With Defaults?

Step 1 – Contact A Broker

Contacting a broker is especially important for those who have been declined for a mortgage due to their credit history.

Instead of further damaging your credit report by reapplying and facing another rejection, it is best to contact a specialised mortgage broker.

Also, a lot of specialist lenders (who offer mortgages to individuals with poor credit history) will require an introduction from a reputable broker.

Step 2 – Check Your Credit History

Even if you know of a default on your record, your broker will advise you to review your credit reports. This is to ensure there are no errors or other factors that could impact your approval.

Moreover, they can guide you on how to dispute any inaccuracies or, at the very least, add a note to your report to explain any late or missed payments.

You can also verify if your default status has been updated to “satisfied” after successfully paying off the debt.

Step 3 – Conduct A Credit Repair

Lenders not only consider the defaults on your credit report but also review your overall credit management. To assess your creditworthiness, they examine various aspects of your report.

So, before applying for a mortgage, there are several actions you can take to enhance your credit report.

These actions include decreasing the percentage of available credit you are using, reducing your debt to income ratio, avoiding reaching or exceeding credit limits on credit cards, etc.

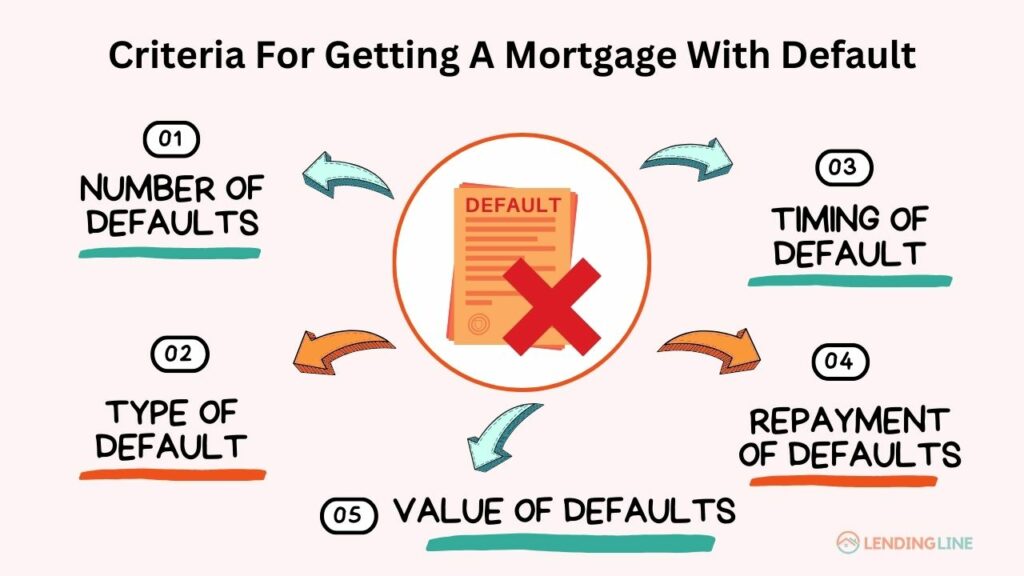

Eligibility Criteria For Getting A Mortgage With Default

Each lender has specific criteria regarding applications with defaults, making it essential to consult an expert broker for personalised advice.

However, given below are some general factors most lenders may consider:

1. Number Of Defaults

Needless to say, multiple defaults pose a higher risk of rejection compared to a single default on your record.

Some lenders explicitly state the maximum number of defaults allowed within a specific period.

2. Type Of Default

The nature of the defaulted debt significantly affects approval chances. Defaulting on secured loans or missing multiple mortgage payments is viewed very negatively.

However, lenders tend to be more lenient if the default relates to a mobile phone contract or similar obligations.

3. Timing Of Default

Although older defaults are viewed more leniently, lenders have varying requirements. Certain lenders do not accept any defaults within the last six years.

On the other hand, some can consider applications if the defaults occurred recently.

4. Repayment Of Defaults

Certain lenders consider applications only if all outstanding debts have been settled and the default status has been updated to “satisfied” on the credit report.

5. Value Of Defaults

For some lenders, the amount of the default is crucial. For example, they may decline an application if the total defaults exceed £500 or if a single default amount exceeds £250.

How Your Income Can Affect Your Mortgage Approval

The importance of “income” in determining your eligibility for a mortgage with defaults varies among lenders.

While lenders can consider 100% of the basic salary, some may only accept 50% of bonuses, overtime, and other additional income.

Requirements regarding self-employment also differ, with some lenders demanding a minimum of 3 years of self-employment.

Others may lend to individuals with just one year of trading. Similarly, some lenders require applicants to have been in the same role for 12 months, while others seek a 12-month employment history with the same employer.

That said, maximum loan amounts are influenced by existing financial commitments and outgoings.

This is because individuals with significant monthly personal loan repayments have less capacity to afford new mortgage repayments than those with the same income and no other financial obligations. No rocket science there!

Frequently Asked Questions

1. How Soon After A Default Can You Get A Mortgage?

As time passes, the impact of a default on your ability to secure a competitively priced mortgage diminishes. After six years of record on your credit file, you can start repairing your credit rating.

2. How Long Does A Default Stay On Your Credit File?

The default will reflect on your credit file for six years, which can impact your future credit opportunities.

But contrary to popular belief, obtaining a competitive mortgage specifically designed for individuals with adverse credit can be done. This is the case even if one or multiple defaults are recorded on your file.

3. How Much Can You Borrow If You Have Defaults?

It all depends on the lender. For example, some lenders, even specialist lenders, may not use 100% of additional income such as overtime, shift allowance etc whereas others may be able to take these into account.

They will review your expenditure, the new mortgage payment and your overall income to fully assess the amount you can borrow.

Your home may be repossessed if you do not keep up repayments on your mortgage.

All content is written by qualified mortgage advisors to provide current, reliable and accurate mortgage information. The information on this website is not specific for each individual reader and therefore does not constitute financial advice.

Our goal is simple - to provide most up-to-date and accurate mortgage information to make your mortgage journey as stress-free as possible. Have a question? Fill up the quick form and one of our mortgage advisor will connect with you.