Mortgage interest rates in the UK with certain lenders have risen to as high as 7.93% and beyond (as of September 2023), which for many has made purchasing a new home financially concerning.

In such cases, it is commonly believed that an entirely new mortgage must be taken, but it doesn’t necessarily have to be so.

Certain lenders can allow you to keep the existing mortgage, eliminating the need to search for a new mortgage deal through a process called “porting”.

So, here’s all you need to know about porting a mortgage and what you need to be mindful of while undergoing the process.

Table of Contents

- What Does Porting A Mortgage Mean?

- How Does Porting A Mortgage Work?

- Is Porting A Mortgage The Right Option For You?

- Factors That Can Affect Your Chances Of Getting A Mortgage Port

- Advantages And Disadvantages Of Porting A Mortgage

- Misconceptions Surrounding Porting Mortgages

- Do You Have To Pay A Deposit When Porting A Mortgage

- FAQ

What Does Porting A Mortgage Mean?

Porting a mortgage is a process that transfers your existing mortgage from the old property to a new one.

Note that not every mortgage can be ported over, which requires you to be mindful of the terms of the mortgage before approaching the porting process.

How Does Porting A Mortgage Work?

The process of porting a mortgage is often an involved process, requiring plenty of paperwork and that you repay the existing mortgage. Once the mortgage is paid off, the same deal is then applied to the new property often simultaneously by the lender.

This becomes complicated because of how affordability is considered by lenders.

Even with timely payments on the existing product, lenders need to redo the affordability tests & credit searches for your application to ensure that they remain compliant with financial regulations and meet the lenders criteria at that time.

Moreover, this gives them additional assurance that you are able to repay them successfully.

Is Porting A Mortgage The Right Option For You?

Determining whether a porting mortgage is right for you or not depends on several factors that involve a careful examination of your financial and personal circumstances.

Firstly, you should consider whether you can find a better deal than the existing mortgage or not. If you can, then it would be better not to port the mortgage over to the new property.

Should newer deals end up being more expensive, check how they compare to the switching fees for a mortgage port. There is always a chance that the switching fees make the port a lot more expensive than a newer deal.

Next, be mindful of the price of your new property. If its price is higher than your current home, then you will need to borrow more money. In such cases, some lenders may not be willing to lend you more money than the existing mortgage, which can be troublesome.

And lastly, check with your lender about the possibility of porting the existing mortgage. Some lenders may not be willing to port the mortgage over, which will eliminate the option entirely.

By keeping these points in mind, you will be able to evaluate whether keeping the existing deal is worth it or not compared to new deals available at that time.

Factors That Can Affect Your Chances Of Getting A Mortgage Port

1. Personal Circumstances

Mortgages last for several years, and during that time, there is a good chance that your personal circumstances have changed. This directly affects the number of options available to you.

A good example of this would be your credit report.

If your credit score has improved, getting a better deal becomes much more likely, and you will be able to browse more mortgage options.

But if it has taken a turn for the worse, your lender may inform you that continuing the deal is no longer possible as a port is considered a fresh application.

After all, you must still fit the eligibility criteria, which may or may not have been updated since the original mortgage product was taken out.

2. Property Price

The price of your new property will also affect your chances of getting a porting mortgage.

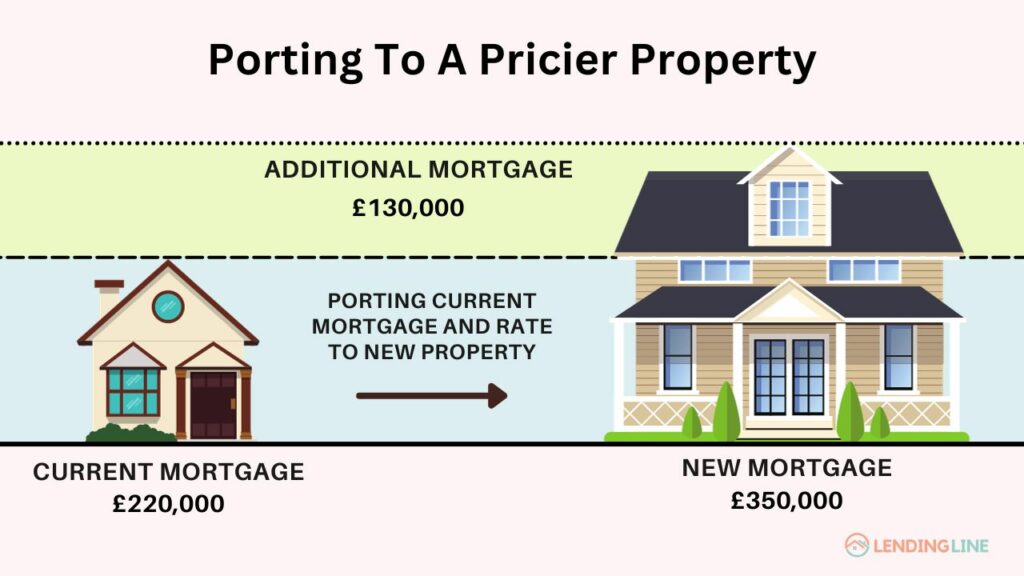

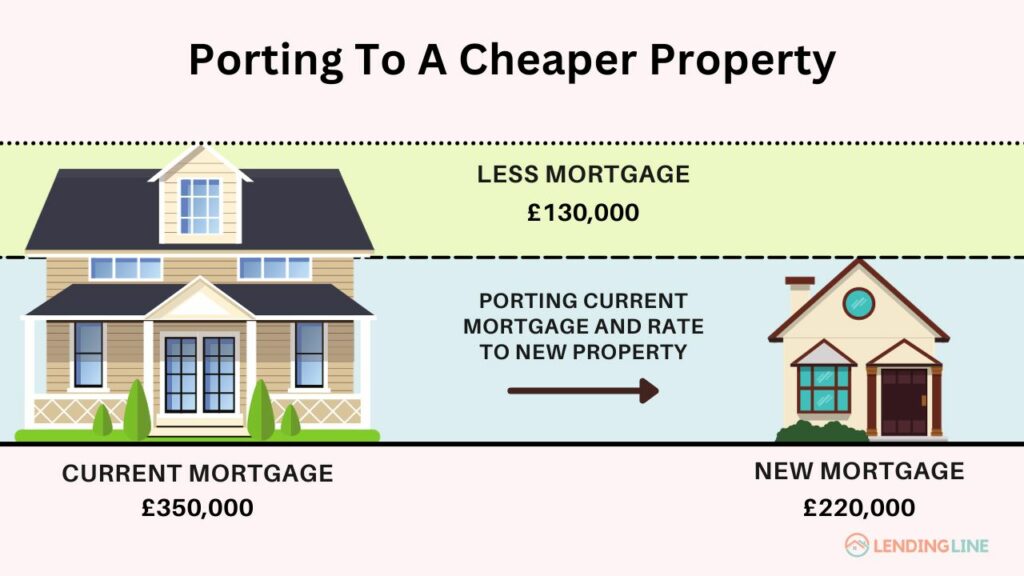

There are two specific outcomes to consider when porting your mortgage: moving to a pricier property or a cheaper one.

The application processes and additional steps vary based on which of these is true for your new property.

Option 1: Porting To A Pricier Property

When moving to a house with a higher value than the existing one, the porting process becomes a little more complex.

As mentioned earlier, the borrower will need to apply for borrowing extra money if they don’t have the funds necessary to cover the price difference, most of the time through a further advance.

This is where both the lender performs several assessments to make sure the new required loan affordability is met.

The lender re-evaluates the elevated price of the property and determines whether the borrower can afford the new mortgage or not. Based on these assessments, they decide whether to approve the mortgage application.

On the other hand, the borrower must assess the risks and decide whether they want to borrow the extra money to cover the additional cost.

If they choose to cover the price difference from their own funds, then the chances of porting the existing mortgage over increase as there is no additional borrowing.

Of course, the flip side is true as well. If the borrower chooses to borrow the extra money, they will be subject to stricter eligibility criteria than their existing mortgage. This could result in a rejected application, which is not a favourable outcome.

Option 2: Porting To A Cheaper Property

When moving to a property with less overall value than your current home, the porting process is can be relatively straightforward.

Since you don’t have to borrow more money in this instance, you only need to keep the lender’s eligibility criteria in mind.

Note that the process for porting your current mortgage to a cheaper property is similar to an ordinary mortgage application as we have discussed above, it is considered a fresh application.

It’s worth remembering that if you port the mortgage to a cheaper property without changing the loan amount, the lender may outright reject the proposition.

This is when the Loan-To-Value ratio in such cases becomes higher than before, resulting in the lender viewing the deal to be riskier. This would also alter the existing LTV banding that was selected for the existing product.

Always consider potential early repayment charges if you need to pay any of the loan off on the existing product.

3. Property Type

Porting your mortgage to a new home with standard construction is typically seen to be low-risk for most lenders.

That said, if you choose to move into a property with unique attributes or a non-standard construction, the prospects of a successful application become slimmer.

Non-standard properties are inherently a part of a niche market, which makes it difficult for the lender to resell in the event of a repossession.

And the more unique the property, the less likely it will be for a lender to approve the mortgage port.

You can expect lenders to consider the following property types as high-risk and thus may have additional criteria to meet:

- New builds

- High-rise flats

- Buildings with unique properties

- Uninhabitable properties

- Listed buildings

- Ex-local authority

- Non-standard construction

- Timber frame

Building societies and banks, in particular, are more stringent about porting mortgages to such properties.

An experienced broker will help you understand whether the new property will be within the lender’s criteria.

Additionally, many lenders require a higher deposit amount while porting to non standard properties to offset potential risks.

4. Credit File

Like with standard mortgage applications, borrowers looking to port their mortgage are seen as high-risk if they have a poor credit file. This results in lenders asking for a larger deposit amount or simply rejecting the application.

So, if you have a poor credit file, note that certain high street banks and building societies may not entertain your application at all. This is particularly true if your credit issues have been within the past two years.

That said, if an existing mortgage is shifted to a new property with few or no changes, there is a chance that the lender approves the application with more flexibility, however this will be lender dependent.

Another thing to remember is that if the mortgage port is declined because of bad credit, you may still be able to find bad credit lenders.

These lenders can assess your credit issues based on the recency of the issues and the reason behind them and provide you with a mortgage deal.

Of course, the deals offered by such lenders are not as good as those offered to someone with a good credit file. In terms of your existing mortgage, going down the new lender route rather than porting could mean early repayment charges.

Advantages And Disadvantages Of Porting A Mortgage

If you are on the fence about porting a mortgage, it’s important to weigh your options up carefully.

There are distinct upsides and downsides to porting a mortgage that you should keep in mind before committing to a decision.

Let’s explore these pros and cons briefly to help you make an informed decision on mortgage porting.

Advantages of Porting A Mortgage

One of the most prominent advantages of porting a mortgage is that by porting, you will retain the existing mortgage rate.

If you have managed to secure a particularly good deal for your current home, in theory you will be able to keep this rate on your new property.

Sometimes, this leads to an interest rate that is noticeably lower than other deals available on the market.

Additionally, by retaining the existing deal with your current lender, you may not have to pay any Early Repayment Charges (ERCs). This can help reduce the financial strain that comes with the purchase of a new property.

Disadvantages of Porting A Mortgage

The issues with mortgage porting only arise if the value of your new property is significantly different than the existing one.

If you need to borrow more money, there is a chance that the lender limits the possible loan amount based on affordability calculations.

Additionally, porting and a further advance can be an expensive option, particularly if the borrowed amount is large as the additional borrowing will be at current market rates which may be higher than your existing deal.

This also results in two mortgages with different rates, which can quickly become difficult to manage, for example each product end date may finish at different times.

And lastly, porting can cause you to miss out on better mortgage rates that could potentially save you plenty of money. Finding a better deal is often difficult, but it ends up being worth the effort.

A good broker will compare the cost of porting and any new purchase mortgage products available at the time.

Misconceptions Surrounding Porting Mortgages

1. Lenders Provide Customers With Perks For Porting Mortgages

The belief that lenders will provide a borrower with some incentive to port a mortgage is not generally true.

This is only true in a niche scenario when a lender offers the borrower an exclusive deal that other lenders can’t match.

So, when applying for a mortgage port, it’s usually wise not to expect a bonus from your lender.

2. Porting A Mortgage Is Always The Quicker Option

While this can be true, there will be instances where porting a mortgage may take more time than expected.

Especially if there is no additional borrowing clients often think because the current mortgage is being paid it is really quick to move to the new property, this is not the case it is classed as a fresh mortgage application as we have discussed.

A longer porting process may occur when you are borrowing more money for a more expensive property or if your personal circumstances have changed for the worse since the original product was taken out.

To save as much time as possible on the porting process, consider consulting a specialised mortgage broker who will support you with your application. .

3. Avoiding Early Repayment Charges Is Always The Best Option

This is a piece of advice that should be evaluated on a case-by-case basis. While porting is a good way to avoid Early Repayment Charges, by no means is it always the best financial decision.

In certain cases, simply switching to a better deal is a more suitable option than to port a mortgage and avoid the ERCs.

Do You Have To Pay A Deposit When Porting A Mortgage

As is the norm with any mortgage application process, paying a deposit is a part of the porting process.

This is typically in the form of the equity that you have currently in your property instead of having cash at the ready.

FAQ

1. Are there any charges associated with mortgage ports?

There is no dedicated porting fee usually, but the process may involve other charges. You may have to pay the lender some amount for processes like property valuation after applying for the mortgage port.

2. Is porting the same as remortgaging?

Porting and remortgaging are fundamentally different concepts, remortgaging around refinancing a property, porting over purchasing a property.

Also Remortgages see the end of one mortgage deal and the beginning of another, whereas porting can be seen as an extension of the existing deal to a new property.

Our goal is simple - to provide most up-to-date and accurate mortgage information to make your mortgage journey as stress-free as possible. Have a question? Fill up the quick form and one of our mortgage advisor will connect with you.