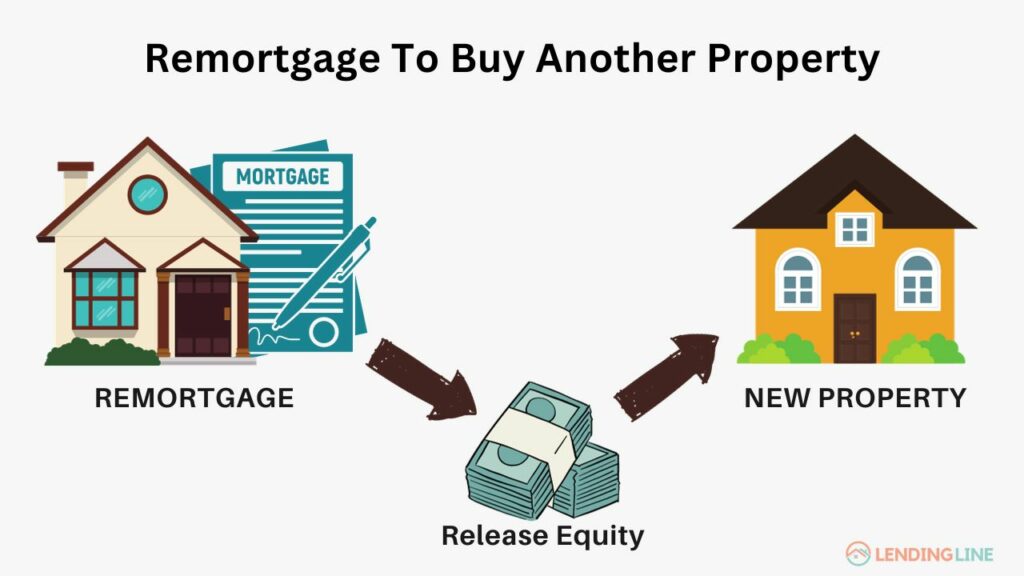

Buying a second property is not an easy task, particularly if you need more funds to successfully secure the purchase.

This can be made easier if you remortgage to buy another property, where your equity in the existing home can become useful.

The financial convenience of remortgaging makes it one of the best options for those seeking to purchase a second home or a buy-to-let property.

It’s no wonder that in Q3 2022, approximately 24.9% of the mortgages in the UK were remortgages.

So, here’s a complete overview of remortgaging for a second property and what you should keep in mind while applying for one.

Table of Contents

- Can You Remortgage To Buy Another Property?

- Eligibility Criteria for Remortgage To Buy Another Property

- Transaction Types With A Remortgage

- How Much Can You Borrow?

- How To Buy A Second Property With Bad Credit

- Using A Buy-To-Let Remortgage To Expand Your Portfolio

- The Legal Expenses Involved In A Remortgage

- FAQ

Can You Remortgage To Buy Another Property?

Yes, getting a remortgage to buy a second home is possible, albeit with certain restrictions. The most prominent of these restrictions is the criteria a lender expects you to fulfil.

Typically, a mortgage lender will assess your financial situation and decide whether the remortgaging process would meet their lending criteria.

This is heavily dependent on the amount of equity you have in the existing property. So, the more equity you own, the greater your chances of a remortgage as the application is likely to be at a lower LTV.

The lender will also assess your eligibility based on other factors, such as your income, credit score and as mentioned the remortgage loan-to-value.

Note that this can vary from one lender to the next, depending on what they need from the borrower.

Eligibility Criteria for Remortgage To Buy Another Property

Here’s a brief overview of these assessment criteria.

1. Income

Your income will be an indicator of your ability to afford the mortgage. This also factors in the amount of equity you can release as a part of the remortgage, as your borrowing will be increasing.

Lenders are usually willing to lend a mortgage that is four to six times the income of a borrower. Do note that lenders may factor in any secondary sources of income while assessing your application, such as maintenance payments, child benefits, etc.

The lender will need to underwrite that you will be able to repay two mortgages at the same time if you are taking out a mortgage on the onward property.

If you are remortgaging a buy to let property or the onward purchase will be a buy to let property, either properties obtained rental income will play more of a factor in the affordability underwriting alongside personal income.

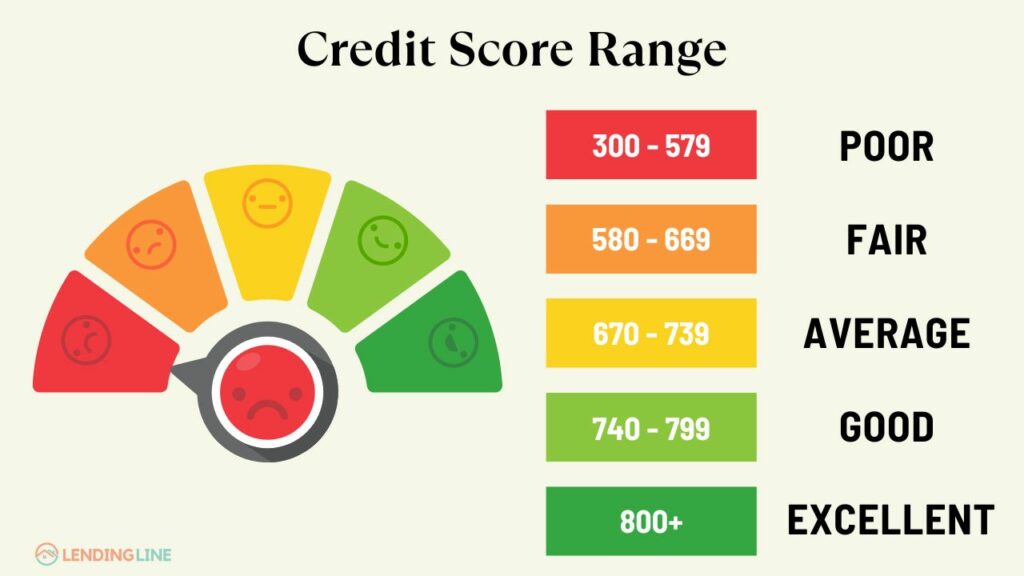

2. Credit Score

Like other types of mortgages, your credit file has a direct impact on your ability to remortgage a house to buy another.

A poor credit score is an indication of late payments, declined cards, and general unreliability, which reflects poorly upon your chances of getting the remortgage.

That said, if you own a high percentage of equity in your existing home, your chances can improve by a significant degree even in this instance.

On the other hand, having a good credit score is a clear indication of someone who pays their dues on time. As such, the lender will feel more comfortable providing you with the desired loan amount.

3. Loan-To-Value

The ratio of the mortgage amount and the value of the property is what is known as ‘Loan-To-Value’ (LTV). This ratio can help you assess the amount of equity that you will be releasing in the remortgaging process.

A current higher LTV ratio will allow you to release less equity and, in turn, make it harder for you to get the desired remortgaging deal. Additionally, a lot of lenders have stricter criteria at higher LTVs surrounding the purpose of the released funds.

4. Employment Type

The likelihood of getting a remortgage can vary based on the type of employment.

For self-employed individuals, remortgaging can be significantly more difficult as lenders tend to view non-salaried people as high-risk borrowers.

In contrast, if you are a salaried individual who can provide the pay slips of at least the past three months, your chances improve notably.

Transaction Types With A Remortgage

The property/occupation type is one of the most important factors to consider when getting a remortgage for a property to release equity to buy another. It is typically the point around which the negotiations for the mortgage loan revolve around.

Some of the transaction types that are common with a remortgage include but are not limited to the following:

1. Let-To-Buy Properties

A let-to-buy is when you have purchased a new home to reside in while renting the current property to tenants. This converts the mortgage on the existing property to a buy-to-let mortgage, which enables you to opt for a residential mortgage on the new one.

2. Buy-To-Let Properties

Buy-to-lets are the ideal option for those who are purchasing a property for the purpose of renting it to tenants. Borrowers are expected to pay a higher deposit amount and interest rates as buy-to-lets typically become a source of income and are seen as higher risks by lenders.

3. Holiday Lets

Holiday lets are properties that are purchased to be rented to people for a short period of time. These properties are typically used as a hotel or AirBnB and are located in prime vacation locations.

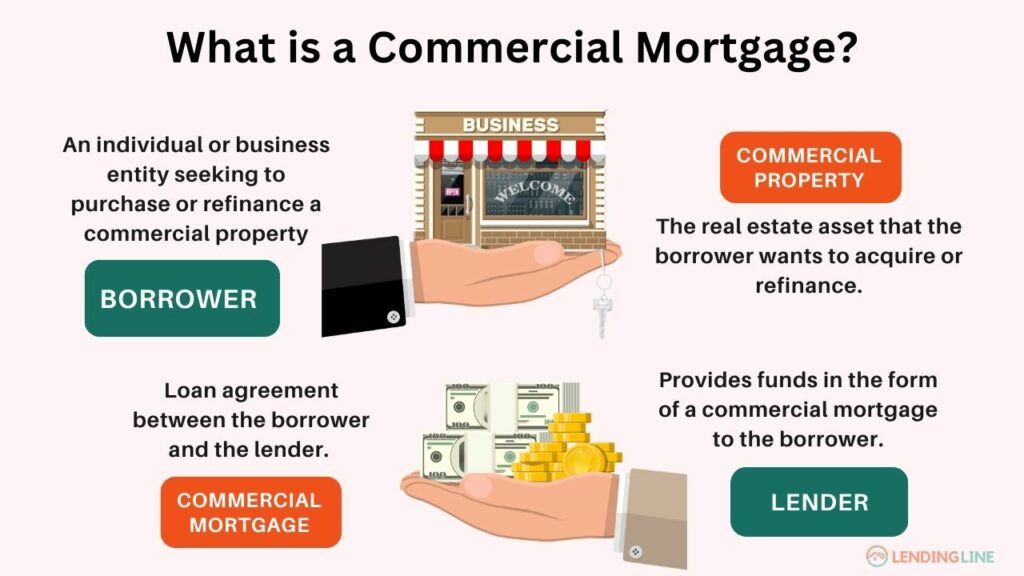

4. Commercial Properties

You can also use the money raised through remortgaging to invest in a new business, such as a retail structure or a restaurant. If you already own a commercial property, you can also refinance it to fund the purchase of another.

How Much Can You Borrow?

There are limits to how much money a lender will be willing to let you borrow. In addition to the eligibility criteria mentioned earlier, you can expect a lender to assess your profile in detail.

Aspects of your life, such as your age, reason for remortgaging, and credit history, play a role in this as we have discussed.

Lenders will typically offer remortgages for 80 to 85% LTV, with a 95% LTV being an unusually rare circumstance when it comes to purchasing another property.

The number tends to hover around 85% for remortgage applications where you are remortgaging to purchase another property. This can vary depending on the lender.

So, when you scour the market for remortgaging options, expect the amount you borrow to be 85% at most. For higher LTVs you will likely be helped by an experienced broker with knowledge on the market.

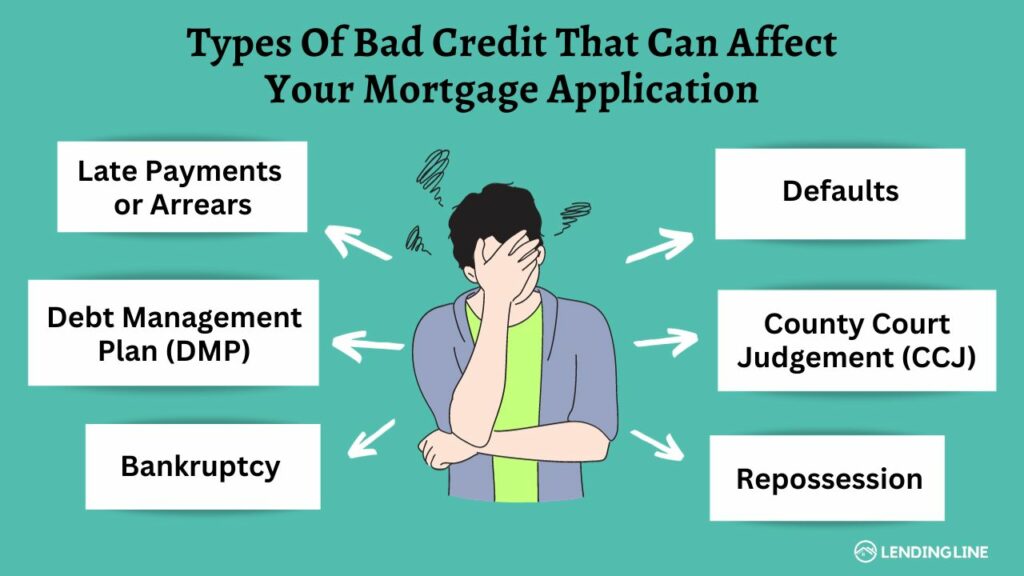

How To Buy A Second Property With Bad Credit

As is the case with other mortgage options, it is perfectly within reason to find a remortgage with a bad credit file. However, expect your options to be severely limited as a consequence of your poor credit history.

Moreover, lenders will likely expect a higher interest rate and deposit amount from you, making the property purchase significantly more expensive. So, if you can afford to wait a little while and mend the issues with your credit file, it maybe worth the hassle.

If you face one or more of the following issues, the chances of receiving a good deal reduce drastically.

- Payment defaults

- Bankruptcy

- Having an IVA

- Past repossessions

- Late payments

- Ongoing or recent debt management plans

Generally, a bad credit score is considered to be below a certain range. For some credit referencing agencies, the score needs to be as low as 379 to be considered poor, whereas it can be around 560 for others.

Using A Buy-To-Let Remortgage To Expand Your Portfolio

Using a buy-to-let remortgage is one of the best options for anyone looking to remortgage their home to purchase another property. In fact, it is the strategy that landlords make use of the most often, and it ends up being rather lucrative for them.

If you are a landlord, consider opting for an interest-only mortgage. This allows you to repay the capital amount of the property once the mortgage ends, which ends up being more beneficial potentially due to reduced ongoing monthly payments.

It’s worth noting that the equity percentage required to re mortgage to purchase another property may be a little lower in residential properties than in buy to let or commercial ones, where lenders will typically require a lower LTV.

Residential homeowners tend to pay the mortgage balance and the loan interest simultaneously, so if you are borrowing more to purchase another property a high LTV with increased interest rates and loan amounts may make the prospect of making these payments difficult so this is important to consider.

As discussed you canchoose to remortgage a portfolio or residential property if you are looking to purchase a home to live in. This can require assistance from a professional advisor to find out which transaction type suits you the best and then suitable mortgage products can be chosen from there.

The Legal Expenses Involved In A Remortgage

Consider any legal fees to complete the remortgage which can vary based on the property value, mortgage type, and pending legal work. Some lenders as part of their remortgage application may allow a free legal service or cashback products should you pay the legal fees yourself.

Another major expense is the Stamp Duty Land Tax (SDLT), the rates for which are 3% higher for second properties.

Legal expenses can be mitigated somewhat if you choose to remortgage with the same lender.

Doing so will eliminate solicitor fees entirely from the re mortgage element, since the remortgage is considered to be a further advance without involving a new lender. This may be suitable if you are locked into a current mortgage product with early repayment charges

FAQ

1. What is the deposit amount needed to purchase a second home?

The deposit amount that you should be prepared to pay can be somewhere around 15% to 20% for the second property. It’s always wise to look at availability for more funds should this amount turn out needing to be higher.

Ultimately this will be dependent on circumstances, if the onward purchase was a buy to let property the required deposit would be higher.

2. Is it possible to remortgage my home to raise funds for another if I have a new job?

Being newly employed does raise a few concerns among certain lenders, but it should not affect your chances of getting a remortgage too heavily. If you have plenty of equity in the home, and your financial conditions are good enough to repay the mortgage, don’t be worried.

3. Is it better to remortgage or get a second mortgage?

Whether it’s better to remortgage or get a second mortgage depends on your personal circumstances, including your current mortgage rate, the rates available for a remortgage or second mortgage, and your long-term financial goals. It’s best to consult with a mortgage advisor to make an informed decision.

4. Can I have 2 residential mortgages?

Yes, it’s possible to have two residential mortgages. However, the lender may want plenty of evidence before approving a second residential mortgage.

Otherwise, the second property may be considered an investment property by lenders, which could lead to different lending criteria, potentially higher interest rates or a rejected application if you initially applied on a residential basis.

Lenders will want to stop so called ‘back door’ buy to lets where rental properties have been acquired through residential mortgages.

Your home may be repossessed if you do not keep up repayments on your mortgage.

All content is written by qualified mortgage advisors to provide current, reliable and accurate mortgage information. The information on this website is not specific for each individual reader and therefore does not constitute financial advice.

Our goal is simple - to provide most up-to-date and accurate mortgage information to make your mortgage journey as stress-free as possible. Have a question? Fill up the quick form and one of our mortgage advisor will connect with you.