In many situations, people do not have the finances needed for constructing a building, be it for residential or commercial purposes.

So, they need to borrow money in order to construct the property. Traditional residential mortgages are not suitable for such purposes. That’s where self-build mortgages can be very handy.

Standard residential mortgages are where a lender will loan money against the value of an already constructed property and use this property as security for their loan.

In contrast, in self-build mortgages, you get access to the funds in various stages as the building is constructed and the lender will loan money based on the future value of the property being built.

This guide takes an in-depth look at how self-build mortgages work and whether they are suitable for you.

Table of Contents

- Types of Self-Build Mortgages

- Stages Of Funding in Self-Build Mortgages

- Self-Build Mortgages Eligibility Criteria

- Mortgage Rates for Self-Build Loans

- How Much Can You Borrow Under Self-Build Mortgages?

- Getting A Self-Build Mortgage

- Documents Needed for A Self-Build Mortgage Application

- Alternatives To Self-Build Mortgages

- FAQs

- 1. Which lenders offer self-build mortgages?

- 2. Do you need to pay stamp duty when constructing a building using a self-build mortgage?

- 3. Is a self-build mortgage the same as development finance?

- 4. What are the costs to consider when applying for a self-build mortgage?

- 5. What happens if the cost of a particular building stage is higher than the funds provided?

- Conclusion

Types of Self-Build Mortgages

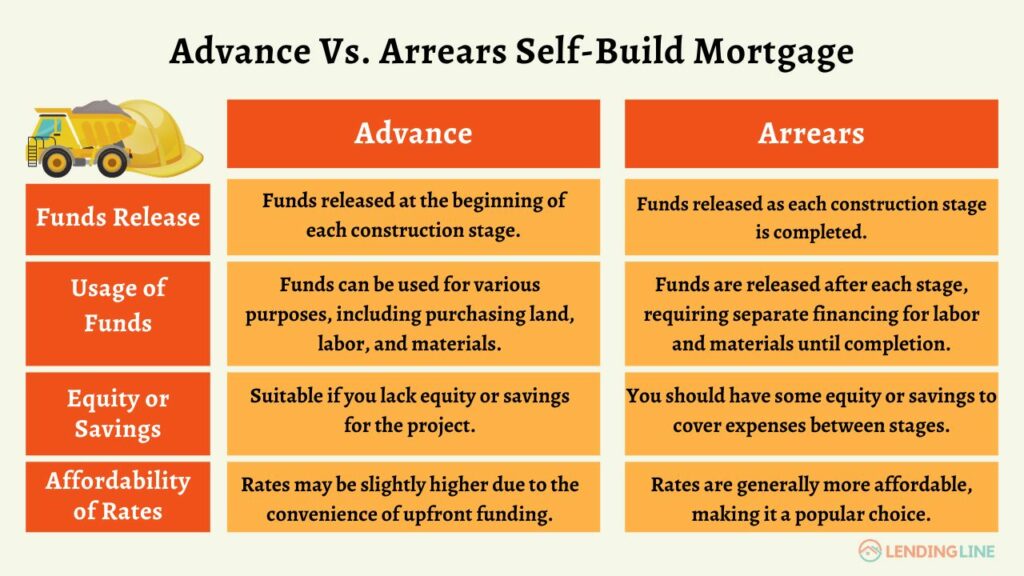

There are two types of self-build mortgages:

1. Advance

Under an advance self-build mortgage, the lender will release the funds required at the beginning of every stage of the construction project.

Thus, the money can even be used for purchasing the plot of land on which construction is to take place or for procuring labour and materials.

This type of mortgage can be beneficial if you do not have equity or savings for the project. However, fewer lenders offer an advance self-build mortgage and those who do usually retain some percentage of the loan amount until the project is completed.

2. Arrears

This is the exact opposite of advance self-build mortgages, where the lender provides the funds as each construction stage ends. Because of this, you need to arrange the finances for purposes like labour and materials until a particular stage is complete and the next one starts.

A larger number of lenders are willing to provide this type of mortgage, which is why it is more commonly used. The rates for this self-build mortgage are also more affordable than those for advance self-build options.

Stages Of Funding in Self-Build Mortgages

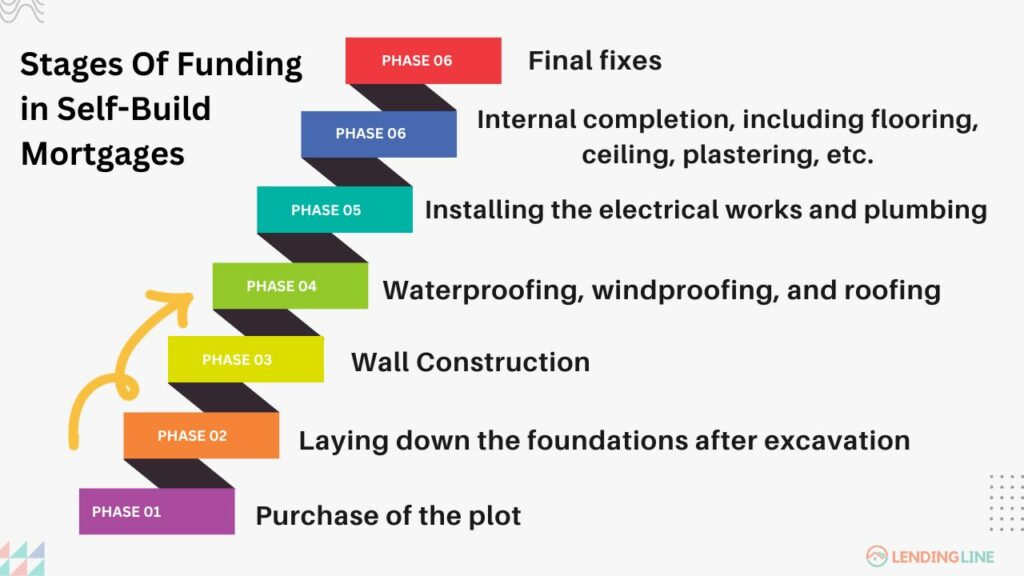

Since the lender is providing a loan against a property that is not yet complete, the risk is considerably higher than with standard residential mortgages.

To protect themselves from this risk, money is released in stages, depending on whether the mortgage is an advance or an arrears product.

Generally, there are five to seven stages in each construction project, which can involve:

- Purchase of the plot on which construction is to be done (depending on the lender)

- Laying down the foundations after excavation

- Wall Construction

- Waterproofing, windproofing, and roofing

- Installing the electrical works and plumbing

- Internal completion, including flooring, ceiling, plastering, etc.

- Final fixes

Generally, only the interest has to be repaid on self-build mortgages during the construction process. The loan amount will have to be repaid after the project is complete.

Self-Build Mortgages Eligibility Criteria

Self-build loans can be taken by individuals planning to construct a building by themselves or by hiring builders, contractors, and architects.

A site manager can also be hired to supervise the project.

Even first-time buyers can take advantage of this loan if eligible.

However, the lending criteria for such mortgages differ from lender to lender. So, you need to find a lender that you are eligible for and meet their specific criteria.

For this purpose, you can take the help of a specialist mortgage broker, who can help find the most suitable lender for your individual circumstances.

Mortgage Rates for Self-Build Loans

Compared to traditional residential mortgages, the rates for self-build ones are usually higher. In addition, other expenses, such as arrangement fees, can vary between different lenders.

On the plus side, it is possible to switch to a different loan with more affordable interest rates once the building is complete and you are able to remortgage to a standard residential product.

Building completion is generally confirmed by a RICS-qualified surveyor.

How Much Can You Borrow Under Self-Build Mortgages?

The amount that can be borrowed under a self-build mortgage will depend on your financial condition and the project.

This means the lender will consider your income and expenditure, along with any outstanding debts and credit score.

Self-build mortgages are usually available with a 75% loan-to-value (LTV) ratio, so you need to put down at least 25% of the project value as a deposit.

Finding the right lender can help you get more flexible terms. The maximum loan amount with some lenders is around £3 million but other lenders may be able to offer more than this.

Getting A Self-Build Mortgage

The first thing to do when getting a self-build mortgage is to hire a specialist mortgage broker who can help find the best lenders for the project. Such a broker can also help in preparing a project plan and completing the paperwork required for the application.

You should also download your credit reports and review them to identify any factual inaccuracies so they can be rectified in time. Besides this, lenders need to be sure that the project is viable and that each stage has been properly planned.

For this, you will need to provide them with detailed information regarding timeframes, projections, risk assessments, etc. Make sure to get the permits required from the respective authorities for the construction. Sometimes, the lender may want the project to be supervised by a consultant or architect, so be prepared for that as well.

Documents Needed for A Self-Build Mortgage Application

Lenders require several documents to obtain information regarding the building project before they can assess your application. These include:

- Evidence of planning permission

- Proof of the building regulations approval

- Specifications and drawings regarding the project

- Project cost estimates

- Site insurance and structural warranty

- Details regarding the indemnity cover of the architect

The lender may carry out an initial valuation of the project to determine its current and expected finished values, which will require valuation fees. Final valuations are completed by a RICS valuer and provided to the lender. This process can take up to three months.

Alternatives To Self-Build Mortgages

If you have an existing property, the equity in that property can be used as an alternative to self-build mortgages.

It can be used to obtain a short-term bridging loan or a remortgage, which are easier to obtain than a self-build mortgage. Just make sure to compare different options from multiple lenders before making a decision.

FAQs

1. Which lenders offer self-build mortgages?

As mentioned before, a limited number of lenders offer self-build mortgages compared to residential mortgages. Some well-known lenders in the UK include Halifax, Scottish Building Society, Newcastle Building Society & Lloyds.

2. Do you need to pay stamp duty when constructing a building using a self-build mortgage?

Buildings constructed using self-build mortgages are not subject to stamp duty if you already own the land. Even if you don’t own the land, you will only have to pay stamp duty on the value of the land rather than the final property value.

3. Is a self-build mortgage the same as development finance?

Self-build mortgages are different from development finance as the latter is used for larger projects. Property developers use development finance to construct properties they can sell or rent out for a profit.

4. What are the costs to consider when applying for a self-build mortgage?

You need to consider several costs when applying for a self-build mortgage, such as:

- Broker fees

- Architect fees

- Legal fees

- Insurance

- Builder’s/contractor’s cost

- Building regulation fees

- Planning permission fees

5. What happens if the cost of a particular building stage is higher than the funds provided?

The best way to protect yourself against such circumstances is through insurance, which can also help cover other costs like those caused by vandalism and theft.

Conclusion

Self-build mortgages offer an excellent solution when you require finance for the construction of your dream home. They are especially useful where equity or savings are unavailable and offer advantages like savings on stamp duty.

However, since they are a specialist mortgage product, they are not as easily available as a standard residential mortgage. That is why it is highly recommended to consult a mortgage specialist when applying for such a loan. They can help find you the best lender for your needs and guide you through the application process at each stage of the development.

Your home may be repossessed if you do not keep up repayments on your mortgage.

All content is written by qualified mortgage advisors to provide current, reliable and accurate mortgage information. The information on this website is not specific for each individual reader and therefore does not constitute financial advice.

Our goal is simple - to provide most up-to-date and accurate mortgage information to make your mortgage journey as stress-free as possible. Have a question? Fill up the quick form and one of our mortgage advisor will connect with you.