When students move to densely populated areas for education, there is a significant uptick in the demand for accommodation.

With time, this demand has only risen, which has prompted landlords to invest in student accommodation. After all, more students will always be looking for a place to stay while studying.

If you want to invest in student accommodation, you may look into student buy-to-let mortgages.

Even with the increased base interest rate, there are plenty of great deals to choose from, making buy-to-lets a valid source of long-term income in the right circumstances.

So, let’s see what goes into student buy-to-lets and explore all the details surrounding such rental properties.

Table of Contents

Student Buy-To-Let Mortgages

These are standard mortgages for students buy-to-lets offered by lenders who are content with lending the property to students.

The distinction arises from many lenders being averse to this idea because they perceive student lets to be high-risk.

Such lenders often reject mortgage applications due to the additional considerations that accompany them.

That said, you can find lenders who will accept applications for student buy-to-let aplenty, provided that you and the students you will be letting meet their specific requirements.

These requirements can vary based on the property size, number of occupants and general availability.

If you’re someone who is a parent with university-age children, you can consider getting a buy-to-let mortgage for other students.

That way, you could potentially be able to sustainably pay for the university fees from the rent you earn by accommodating other students.

The Types Of Student Properties

In the ideal circumstance, you would want to borrow against a flat or apartment block that is built specifically for students.

And since these accommodations are already built for university-going students, you can expect lenders to have less stringent lending criteria and be more open to securing their loans on these properties.

Broadly speaking, there are two types of student properties to choose from: traditional student HMOs and Purpose-Built Student Accommodation (PBSA).

Based on the type you choose, your investment can greatly impact your income in the long run.

1. Traditional Student HMOs

HMOs (Houses of Multiple Occupation) are some of the most common student accommodations.

These properties are houses or flats that have been adjusted to fit multiple occupants. Such accommodations typically limit the number of occupants to four or five.

Certain lenders may be willing to lend a property to a maximum of four occupants from separate households without requiring an HMO licence application, depending on the local authority the property is set in.

These structures must usually be no taller than two storeys and are smaller than large HMOs.

However, for properties designed for five or more tenants from separate households, you will need an HMO licence to present to the lender.

After all, the likelihood of property lenders lending a large HMO property without a licence is quite low because, of course the property must be licensed with the local authority.

The number of lenders in this niche is not very high, so finding an HMO may be a little tricky without seeking professional advice from a mortgage broker.

2. Purpose-Built Student Accommodation (PBSA)

Often called pods or cluster flats, PBSAs are high-rise structures that have top-notch services included in the investment that are geared towards students.

These include facilities like security and management, WiFi, shared gyms, and more, making them rather dissociated from the responsibilities that often befall a landlord.

These properties are generally bought through cash-only, meaning that you may have to look for an alternative if you don’t have the required amount in cash.

Until these properties become open to more finance options, it may be better to look at HMOs outlined above as the alternative.

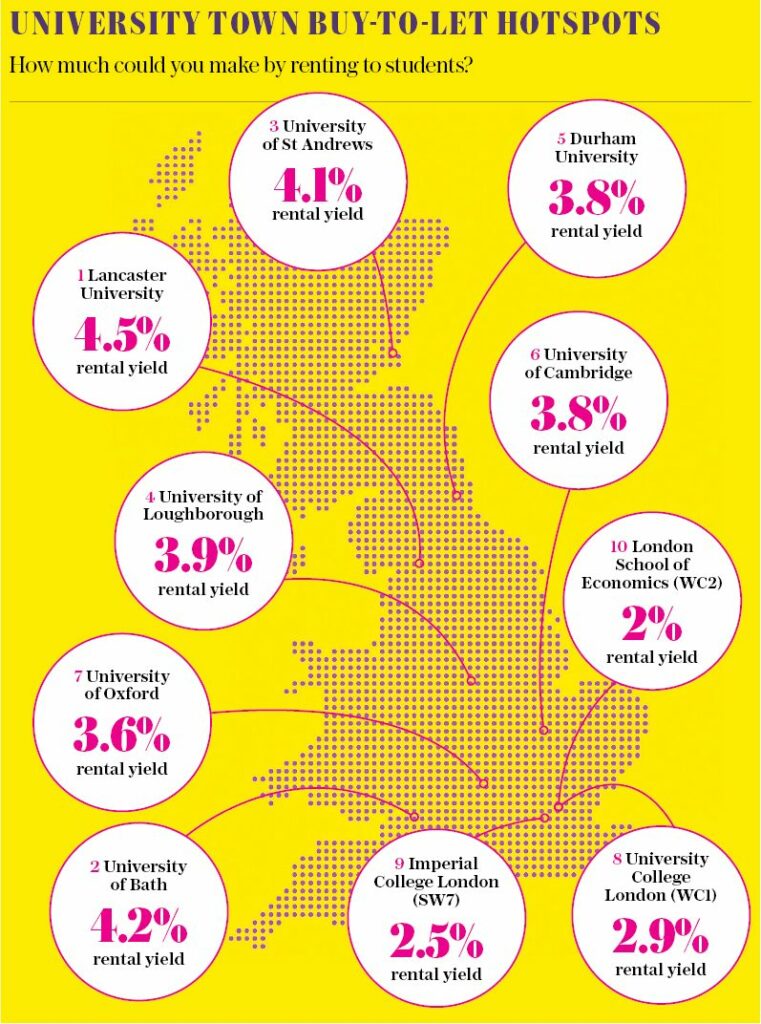

According to ‘The Telegraph’ website, these are the best investment areas in student buy-to-let mortgages.

Eligibility Requirements For A Student Buy-To-Let

In some ways, a student buy-to-let demands more from both the borrower and the lender when it comes to managing the property.

As such, there are several eligibility criteria that a borrower must fulfil to be able to invest in a student HMO.

Listed below are all the typical eligibility requirements for a student accommodation mortgage.

1. Experience As A Landlord

Many lenders let their property only to those with experience as a landlord. Since student accommodation requires more investment and management than a typical buy-to-let, lenders prefer letting the property to an experienced landlord.

Even so, there is a chance that you find a buy-to-let even without any experience. While the options will be limited because of this, you can still remain vigilant for any lenders who will accept your application.

2. Rental Income To Mortgage Loan Ratio

Your rental income needs to exceed your mortgage payments by a factor of 125% at the bare minimum.

Some lenders may require evidence from letting agencies to support this. They may also perform stress tests to see if the rental income can cover your mortgage payments or not.

Depending on the lender, this percentage can go as high as 180%. This means that if your mortgage costs £1,000 each month, the lender will require you to earn £1,800 at the very least.

3. The Required Deposit Amount

As is standard for buy-to-lets, you must deposit about 25% of the property value.

But unlike standard buy-to-lets, the chances of finding a lender who lets an 85% or 90% buy-to-let are extremely low.

As such, finding lenders willing to accept a smaller deposit can be very difficult without professional help from a mortgage broker.

4. Legal Requirements

As mentioned earlier, if you’re renting the property out to five or more tenants, in most cases, you will need an HMO licence.

This licence is valid for five years, and it may set you back by a few hundred pounds based on the property size.

And to receive this licence, you will have to meet further eligibility requirements, as detailed below:

- The property must be suitable for the designated number of tenants

- Those managing the HMO should be capable of managing and maintaining the property

5. Property Valuation By Surveyors

Some lenders may send surveyors to evaluate the property. If the surveyor evaluates the property as a lesser value than expected, the lender may terminate the deal outright if there is not enough equity for the current mortgage product.

This will be coupled with the evaluation of potential rental income additionally.

Pros And Cons Of Buy-To-Lets For Students

There are several advantages and disadvantages associated with student buy-to-lets. It usually relies heavily on the type of property you’re looking for, but you can expect the following benefits in a general sense.

- Consistently high demand and an unfaltering market in certain areas

- Some allow the option of letting to non-students during downtime

- Enables renovations and redecorations during summer downtime

- Students’ parents can be their guarantors in terms of rental income.

That said, student accommodation isn’t always the most beneficial mortgage to seek. Some of the disadvantages include:

- Student buy-to-lets are short-term by nature

- High amounts of paperwork stemming from high tenant turnover

- The property needs to be furnished since students in almost all cases.

Student Properties For Your Child

You can buy a student property for when your child needs it in the future. Consider it an investment that pays off over a long period of time.

While studying, your child can live in this property, learn to save money and provide you with a stream of income as well.

Since the student property you purchase for your child could count as a second home in a certain sense, there are a few legal aspects to be mindful of.

You will have to take care of things like stamp duty, which can add to your expenses. Certain mortgage lenders have specific and specialised products for this scenario.

Alternatively, your child can become a homeowner through a mortgage with a gifted deposit. They will climb the property ladder at a relatively early age, and at the same time, you will save money on legal fees.

Once again, this will make finding a lender very complicated due to the overlap between it being a residential dwelling for the owner alongside wanting to let the property to other students which may live in it.

FAQs

1. How do interest rates compare for standard buy-to-let mortgages against student mortgages?

Interest rates for student buy-to-let properties are usually higher than those for residential mortgages and standard BTL mortgages.

This can vary based on the deposit size and the borrower’s age and income, but it remains true in a general sense.

2. Where can student buy-to-let mortgages be commonly found?

Buy-to-let mortgages for students are in abundance in areas with multiple universities. Expect to find such mortgages in cities and towns like London, Manchester, and Leeds.

**A buy to let mortgage will be secured against your property.

Some types of buy to let mortgages are not regulated by the Financial Conduct Authority.

All content is written by qualified mortgage advisors to provide current, reliable and accurate mortgage information. The information on this website is not specific for each individual reader and therefore does not constitute financial advice.

I am CeMAP & CERER qualified mortgage adviser and have helped a number of clients realise their dreams when they thought it would not be possible. I’m skilled at getting mortgages sorted for people with a history of missed payments, CCJs, defaults, debt management programmes, IVAs and bankruptcies.

I am CeMAP (Certificate in Mortgage Advice and Practice) qualified mortgage adviser with a strong background in Finance. I specialise in providing expert advice on a range of mortgage products, including first-time buyers, remortgages, buy-to-let mortgages and bad credit mortgages.